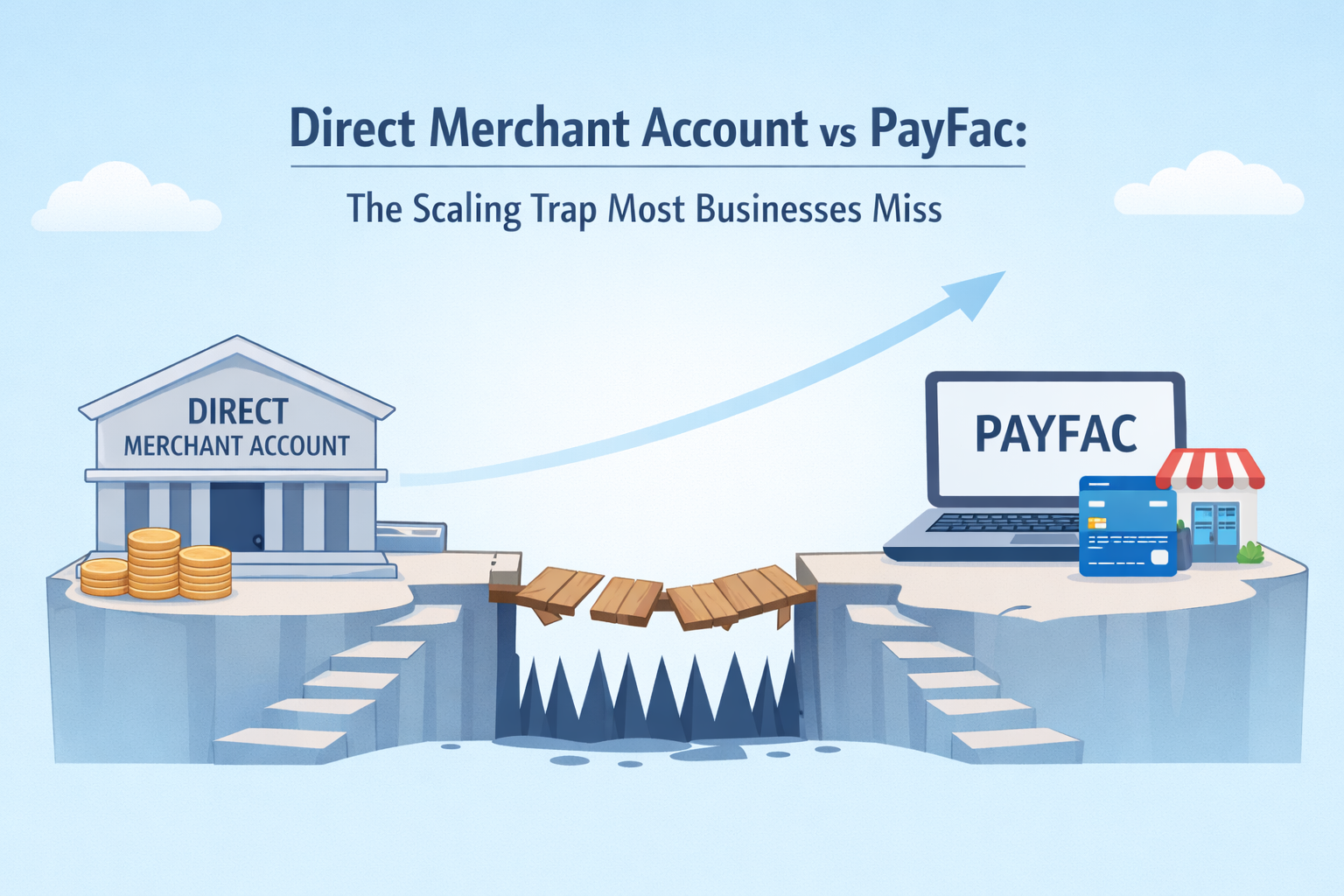

Direct Merchant Account vs PayFac: The Scaling Trap Most Businesses Miss

Posted by By Luis Requejo, HighTech Payment Systems on Jan 1st 2026

Most businesses don’t choose between a direct merchant account and a payment facilitator intentionally. They default into one — usually a PayFac — because it’s faster, cheaper upfront, and marketed as “simpler.”

That shortcut becomes expensive the moment volume, risk, or complexity increases.

Understanding the structural difference between these two models is not optional if you plan to scale revenue without interruptions, frozen funds, or forced migrations.

What a Payment Facilitator (PayFac) Actually Is

A payment facilitator is a master merchant account holder. Your business operates as a sub-merchant under their MID.

This model is used by platforms like Stripe, Square, PayPal, and many SaaS-embedded payment solutions.

Why PayFacs are attractive early

-

Instant or near-instant onboarding

-

Minimal underwriting

-

Flat, predictable pricing

-

No visible processor relationship to manage

The tradeoff nobody emphasizes

You do not control the merchant account.

The PayFac:

-

Owns the relationship with the acquiring bank

-

Sets risk thresholds dynamically

-

Can impose limits, reserves, or termination unilaterally

This structure works for low-risk, low-complexity, low-volume businesses. It breaks under scale.

What a Direct Merchant Account Really Means

A direct merchant account establishes a one-to-one relationship between your business and the acquiring bank, with a processor acting as infrastructure — not owner.

Key characteristics

-

Full underwriting upfront

-

Custom pricing based on risk and volume

-

Dedicated MID

-

Transparent risk controls and thresholds

This is not “harder for no reason.” It’s harder because the bank evaluates you as a long-term counterparty.

The Scaling Inflection Point Where PayFacs Fail

Most PayFac problems don’t appear at $10k/month. They appear when:

-

Monthly volume increases rapidly

-

Average ticket size grows

-

Chargeback ratios approach network thresholds

-

Business models evolve (subscriptions, digital delivery, cross-border)

At that point, PayFacs respond by:

-

Imposing rolling reserves

-

Delaying settlements

-

Capping daily or monthly volume

-

Requesting documentation retroactively

-

Offboarding with minimal notice

This is a structural limitation, not a customer service failure.

Related reading:

-

Merchant account freezes and prevention:

https://www.hightechpayments.com/blog/merchant-account-freezes-why-they-happen-and-how-to-prevent-them-before-cash-flow-stops/ -

Why providers collapse under chargeback pressure:

https://www.hightechpayments.com/blog/why-most-payment-providers-collapse-under-chargeback-pressure/

Cost Comparison: Flat Fees vs Real Margins

PayFac pricing looks simple — until you model it at scale.

Flat-rate pricing bundles:

-

Interchange

-

Risk premium

-

PayFac margin

-

Platform margin

As volume increases, you overpay relative to a direct merchant account where interchange and markup are separated.

This is the same opacity problem discussed in:

https://www.hightechpayments.com/blog/the-hidden-costs-of-payment-processing-how-opaque-pricing-drains-merchant-profits/

Risk Ownership: The Core Difference

PayFac model:

Risk is pooled. When others misbehave, thresholds tighten for everyone.

Direct merchant account:

Risk is isolated. Your performance determines your treatment.

If you operate in:

-

High-ticket

-

Subscription

-

Regulated or adjacent industries

-

International markets

Pooling risk is a liability, not a benefit.

Which Model Is Right — and When

Stay with a PayFac if:

-

Volume is stable and modest

-

Business model is simple

-

Cash flow interruptions are survivable

Move to a direct merchant account if:

-

You are scaling aggressively

-

Margins matter

-

Downtime or frozen funds would cripple operations

-

You want predictable risk management

The worst position is staying on a PayFac too long — until you’re forced to migrate under pressure.

Final Reality Check

This decision is not about convenience. It’s about control, survivability, and cost at scale.

If your processor owns the account, they own your cash flow.

And that’s a risk most growing businesses underestimate until it’s too late.