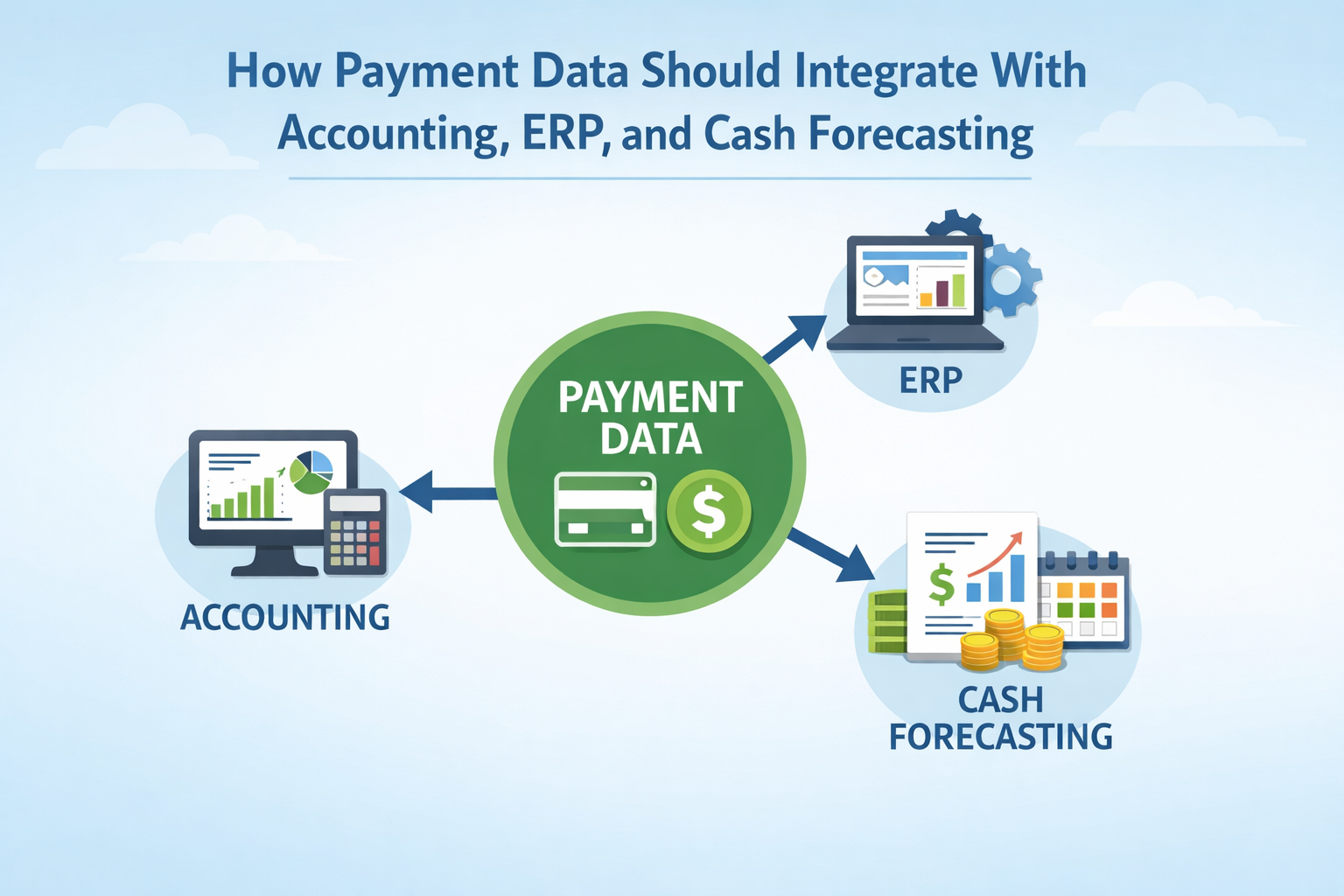

How Payment Data Should Integrate With Accounting, ERP, and Cash Forecasting

Posted by By Luis Requejo, HighTech Payment Systems on Jan 20th 2026

Most businesses think they have payment visibility.

They don’t.

They have transaction logs, not financial intelligence. And the gap between those two is where forecasting errors, cash shortfalls, and surprise risk events are born.

If your payment data does not reconcile cleanly with accounting, ERP, and cash forecasting systems, your growth decisions are being made on partial truth.

Why Payment Reports Are Not Financial Reports

Payment processors are optimized for authorization and settlement, not financial accuracy.

Their reports answer questions like:

-

Was the transaction approved?

-

When did it settle?

-

What fees were deducted?

They do not answer:

-

What revenue is actually earned?

-

What cash is available vs pending?

-

What liabilities exist from refunds, disputes, or reserves?

When businesses rely on processor dashboards as a source of truth, forecasting becomes guesswork.

The Core Problem: Timing Mismatch

The biggest integration failure is not technical. It’s temporal.

Payment data operates on:

-

Authorization dates

-

Capture dates

-

Settlement dates

Accounting systems operate on:

-

Revenue recognition

-

Accruals

-

Refund liabilities

Cash forecasting operates on:

-

Net settlement timing

-

Reserve holds

-

Chargeback exposure

When these timelines aren’t aligned, reported “revenue” and actual usable cash diverge — sometimes dramatically.

This is why payout delays feel sudden even when they were structurally predictable:

https://www.hightechpayments.com/blog/merchant-account-freezes-why-they-happen-and-how-to-prevent-them-before-cash-flow-stops/

What Proper Payment Integration Actually Requires

1. Transaction-Level Granularity

Aggregated summaries are insufficient.

Each transaction must map:

-

Gross amount

-

Fees (interchange, markup, platform)

-

Taxes

-

Refund status

-

Dispute status

Without this, reconciliation becomes manual and error-prone.

2. Clear Separation of Revenue vs Cash

Revenue recognition and cash availability are not the same.

Subscription businesses, pre-orders, and delayed fulfillment models are especially exposed here.

Processors don’t track earned revenue. Accounting systems must.

Failure to separate these leads to overstated income and understated risk.

3. Real-Time Visibility Into Holds and Reserves

Reserves are liabilities, not “temporary inconveniences.”

If reserves are not reflected in cash forecasts, businesses overcommit — and then blame processors when cash tightens.

Related context:

https://www.hightechpayments.com/blog/cash-advance-working-capital-using-payment-data-to-fund-growth-responsibly/

ERP Integration: Where Most Implementations Break

ERP systems expect clean, structured inputs.

Payment data is often:

-

Noisy

-

Inconsistently labeled

-

Fee-bundled

-

Updated asynchronously

Common failure points:

-

Multiple processors feeding one ledger

-

Inconsistent SKU or product mapping

-

FX conversion mismatches

-

Manual adjustments after the fact

These aren’t edge cases. They’re the norm.

The Hidden Risk of “Out-of-the-Box” Integrations

Many processors advertise:

“QuickBooks / NetSuite / Xero integration”

What they mean:

-

Basic transaction import

-

Limited fee visibility

-

No dispute lifecycle tracking

-

No reserve modeling

These integrations look complete until something breaks — usually during growth, audits, or due diligence.

This mirrors a broader pattern in payment architecture opacity:

https://www.hightechpayments.com/blog/the-hidden-architecture-behind-a-real-payment-processor-what-merchants-must-examine/

Cash Forecasting Without Payment Intelligence Is Fiction

Forecasting models that ignore:

-

Settlement lag

-

Chargeback windows

-

Reserve release schedules

-

Cross-border delays

Are optimism engines, not financial tools.

Processors optimize for risk containment, not your liquidity.

If your forecast assumes instant access to gross volume, it will fail the first time conditions tighten.

Who Owns This Problem (Hint: It’s Not Your Processor)

Processors provide data. They do not design your financial controls.

Ownership typically falls between:

-

Finance

-

Operations

-

Technology

When no one owns integration end-to-end, gaps persist indefinitely — until stress exposes them.

This is another form of risk merchants cannot outsource:

https://www.hightechpayments.com/blog/payment-risk-you-cannot-outsource/

What a Functional Setup Looks Like

A mature payment-finance stack includes:

-

Transaction-level feeds into accounting

-

Automated reconciliation logic

-

Separate tracking of pending, held, and released funds

-

Forecast models that reflect processor behavior, not assumptions

Anything less is partial visibility.

The Hard Truth

If your cash forecast depends on processor dashboards, it is already wrong.

Payment data must be translated, not consumed raw.

Businesses that integrate payments properly don’t eliminate risk — they see it early.

The rest discover it when cash stops moving.