How to Spot a Real Payment Processor vs. a Lead-Gen Middleman

Posted by By Luis Requejo, HighTech Payment Systems on Nov 17th 2025

In the payment industry, appearances deceive.

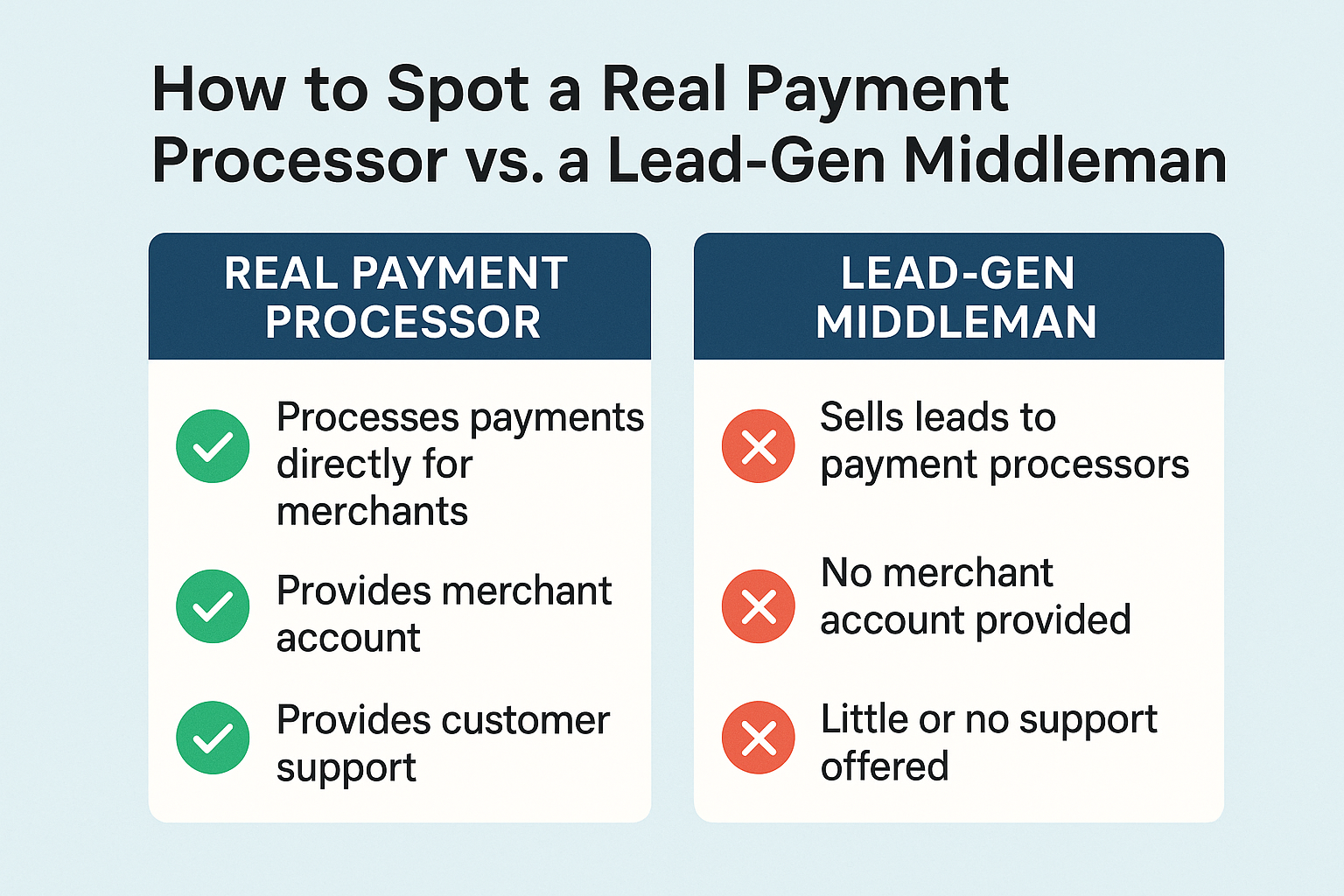

The vast majority of “payment processors” are not processors at all—they’re middlemen, brokers, ISOs, agents, or lead-gen websites pretending to be full-stack payment platforms.

And guess what?

Middlemen don’t control pricing, don’t control risk, don’t control underwriting, don’t control payouts, don’t control compliance, don’t control reserves, don’t control disputes, and don’t control anything that actually affects your business.

But they won’t tell you that.

They rely on one thing: merchants who don’t know how to tell the difference.

This article cuts through the confusion and exposes the exact signs that reveal whether you’re dealing with a true payment processor or a lead-gen middleman disguising themselves as one.

1. Real Payment Processors Own Their Infrastructure

A legitimate processor controls:

-

Transaction authorization

-

Settlement

-

Gateway routing

-

Tokenization vault

-

Data encryption

-

Fraud systems

-

Chargeback systems

-

APIs

-

Dashboard infrastructure

-

Risk scoring

-

Payout pipelines

Middlemen own none of this.

They simply plug into someone else’s system—usually at a markup.

Red flag:

Provider refuses to explain their tech stack or who actually processes transactions.

If they won’t say it, they don’t own it.

2. Middlemen Call Themselves “Processors” but Are Actually ISOs

Independent Sales Organizations (ISOs) are sales entities.

They do not:

-

process payments

-

underwrite merchants

-

manage funds

-

handle disputes

-

control pricing

-

determine reserves

-

manage risk

-

operate tech infrastructure

They are commissioned sales agents.

How to spot an ISO pretending to be a processor:

-

They say “powered by” but hide the upstream provider

-

They use generic terms like “modern payments platform”

-

Their website lacks technical documentation

-

They push “talk to sales” instead of showing real capabilities

-

Their merchant agreement references another company

If the contract lists another processor, you’re dealing with a middleman, not a processor.

3. Real Processors Provide API Documentation—Publicly

The easiest litmus test:

Does the provider publish API documentation?

A true processor:

-

maintains public API docs

-

offers sandbox access

-

provides SDKs

-

has testing tools

-

displays full technical architecture

A middleman:

-

hides all documentation

-

offers PDFs instead of real docs

-

says “API upon approval”

-

claims their API is being “updated”

-

links to documentation that’s actually the upstream provider’s

If there is no real API, there is no real processor.

4. Middlemen Can’t Issue a PCI Attestation of Compliance (AOC)

Real processors:

-

undergo full PCI audits

-

hold Level 1 PCI certification

-

maintain secure card vaults

-

publish security documentation

Middlemen rely on the PCI certification of the processor they resell.

Ask them directly:

“Can you provide your PCI-DSS Level 1 AOC?”

If the answer is anything other than “Yes,” you’re dealing with a reseller.

5. Real Processors Disclose Their Acquiring Bank

Every processor must work with an acquiring bank—the financial institution that backs merchant accounts.

A legitimate processor proudly states:

-

who their bank partner is

-

how settlements work

-

which regions they support

-

compliance relationship details

Middlemen hide this because they don’t actually have an acquiring relationship.

Red flag phrases:

-

“We partner with top banks”

-

“Trusted banking relationships”

-

“In cooperation with leading institutions”

Those statements mean nothing.

A real processor names the bank.

6. Middlemen Use Vague, Generic Marketing Language

If a provider’s website looks like it was written by a copywriter with no technical understanding, that’s because it was.

Typical middleman phrases:

-

“Future-proof payments”

-

“Advanced payment solutions”

-

“Secure and scalable”

-

“End-to-end platform”

-

“World-class support”

-

“Full-service payments”

Notice something?

Not a single one of these statements means anything.

What a real processor shows:

-

uptime metrics

-

routing architecture

-

fraud scoring details

-

technology stack

-

SDK libraries

-

version control

-

developer resources

-

PCI controls

-

regional acquiring maps

If the site is all buzzwords with no substance, it’s a lead-gen operation.

7. Real Processors Publish Actual Pricing

Processors have:

-

interchange-plus pricing

-

published fee tables

-

clear contract terms

-

transparent surcharges

Middlemen avoid publishing pricing because:

-

they mark up base rates

-

they add hidden fees

-

they rely on commission overrides

-

each deal is negotiated for maximum profit

If pricing isn’t visible, predictable, and detailed, you are being sold to—not supported.

8. Middlemen Can’t Explain Reserves or Risk Rules

Ask them:

-

What triggers a reserve?

-

How long is it held?

-

What is the release schedule?

-

What are the chargeback thresholds?

-

What are the fraud criteria?

-

What is your underwriting model?

A real processor can answer these in detail because they set the rules.

A middleman stumbles because they don’t know the rules—their upstream provider does.

9. The Support Team Reveals Everything

Ask a single technical question.

Real processor support can explain:

-

decline codes

-

failed payouts

-

gateway timeouts

-

API errors

-

fraud triggers

-

dispute classifications

-

regional routing

Middleman support can’t explain anything.

They escalate issues to the upstream processor because they have no system access.

If support doesn’t understand payments deeply, the company isn’t a processor.

10. The Merchant Agreement Always Reveals the Truth

This is the ultimate test.

Read the merchant agreement carefully.

If the agreement:

-

references another company

-

redirects underwriting to another entity

-

handles disputes through a third party

-

mentions a processor you never heard of

-

assigns liability to someone else

…then your “processor” is actually a reseller, ISO, or middleman.

Real processors own the agreement.

Middlemen hide behind someone else’s agreement.

11. Middlemen Don’t Show Real Performance Metrics

What they won’t show:

-

uptime

-

latency

-

transaction speed

-

authorization success rate

-

regional performance

-

traffic scaling capacity

-

failover systems

Why?

Because they don’t control these metrics.

Real processors publish performance dashboards publicly.

12. They Over-Promise Capabilities They Can’t Deliver

Middlemen promise anything the merchant wants to hear:

-

“We support your industry”

-

“We can handle your volume”

-

“We’ll get you approved quickly”

-

“We offer global processing”

-

“We have advanced fraud tools”

Reality:

Everything depends on the upstream processor, not them.

When issues arise:

-

they blame underwriting

-

they blame the bank

-

they blame risk teams

-

they blame “compliance review”

Because they have no control over outcomes.

The Harsh Truth: Middlemen Are Fine for Small Merchants—Disastrous for High-Risk or Scaling Merchants

Small businesses processing a few thousand dollars a month may not feel the impact.

High-risk merchants and fast-growing companies will.

Middlemen cannot support:

-

fast scaling

-

international expansion

-

high authorization rates

-

chargeback-heavy environments

-

custom routing

-

enterprise fraud systems

-

API-level integrations

-

stable reserves

-

predictable underwriting

-

high-volume payouts

The moment your business grows, a middleman becomes a bottleneck.

Final Verdict: If They Don’t Control Processing, They Can’t Control Your Future

Choosing a payment provider is not about finding someone who can “set you up.”

It’s about finding someone who can:

-

scale with you

-

protect you

-

fight fraud

-

stabilize payouts

-

manage risk

-

support growth

-

operate globally

-

deliver consistent performance

-

integrate technically

-

defend you during disputes

Middlemen don’t do those things.

They can’t.

They don’t own the systems.

They don’t own the risk model.

They don’t own the technology.

They don’t own the infrastructure.

A real payment processor does.

Before you choose a provider, ask the only question that matters:

“Who actually processes the transaction?”

If the answer isn’t crystal clear—you’re dealing with a middleman.